In this article:

- A Moog survey indicates key trends and challenges face plastics processors

- Machine designers must meet new standards in energy efficiency, productivity, performance and contamination-free operation

- A technology-neutral approach to motion control offers a true competitive advantage

In autumn 2013, Moog surveyed manufacturers and users of plastic injection molding machines about developments in their industry. In this article, the most important results of the survey are discussed including the current needs of manufacturers and users of injection molding machines.

Injection molding encompasses a broad spectrum of applications for which there are machines of differing size, performance and repeatability. Correspondingly, in terms of motion control, there is no single leading technology that fulfills the various requirements to the same degree. Electromechanical, electro-hydraulic and electro-hydrostatic drives exist alongside each other and each motion control solution has its specific strengths for particular applications.

The markets, injection molded products and injection molding machinery

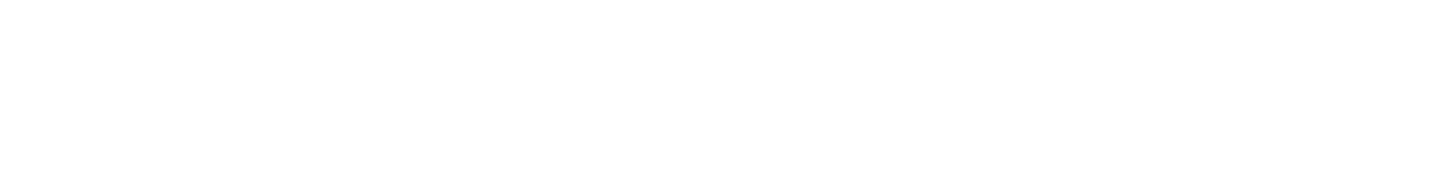

In 2009 the European market processed a total of 10,990,000 tons of polymer through injection molding.

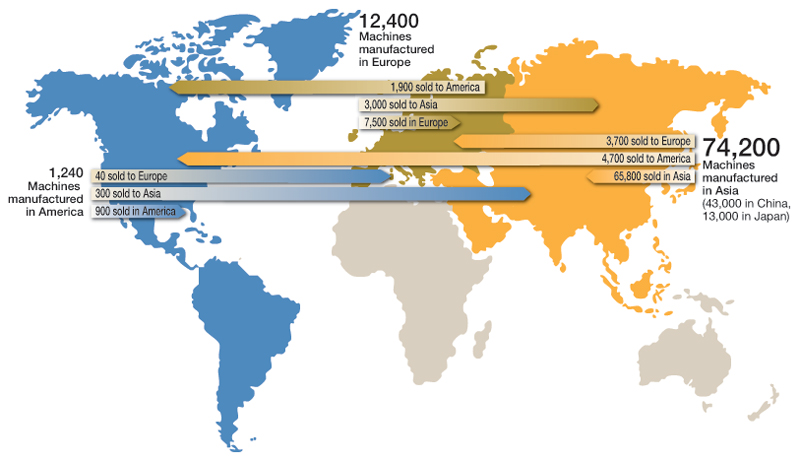

Figure 1 shows the breakdown of the end use markets.

Fig. 1: Packaging accounts for nearly 50% of end use market production.

Source: AMI report M118/March 2010 newly grouped by Moog

The injection molding machine market mirrors the situation in the end product market: In 2012, the machines sold worldwide in the greatest numbers were generic injection molding machines to be used primarily in the production of packaging and in white goods manufacturing.

In general, the market shows steady slow growth at low single digit rates. Slightly higher growth is expected in sales of precision machines and high speed packaging machines. Precision machines are defined by short cycle times and repeatable functions. They are used predominantly for the production of technical parts, as well as in the electronics / telecommunications and automotive parts sectors. High speed packaging machines are very robust and work with a high injection performance, and are seen predominately in applications where thin wall packaging parts such as cups and containers are manufactured in large quantities.

Overview of the market conditions and the most important trends

For successful machine manufacturers, an exact knowledge of the requirements and needs of their customers is crucial. Therefore, we asked plastics processors the following question to get a clear picture of their needs:

What are the most important requirements and needs of the plastics industry at the present time?

We found that today the plastics processing industry is striving to continually reduce overall manufacturing costs. To achieve this goal, plastics processors focus on four keys: energy-saving, materials savings, integration of additional production processes, and higher machine output through greater cavity numbers or shorter cycle times.

Alongside the need to reduce costs, the plastics processing industry has the additional requirement of conforming to the specific demands of production conditions in the sectors of ‘food packaging’, ‘cosmetics and hygiene products’, and ‘pharmaceutical products’. In these sectors, the end product cannot be contaminated by oil, dust and other pollutants. The aim here is to have a manufacturing environment that fulfills the cleanliness demands of these products.

So what are the trends that can be derived from these needs and requirements? The plastics processing industry is targeting four key areas:

- Energy efficiency

- Production

- Machine performance

- Emission-free production

Overall social context: sustainability

At least two of the trends can be regarded as ‘Megatrends’ in the John Naisbitt sense. They are to be considered in the context of the increasing scarcity of resources (e.g. fossil oil) and the general social discussion of sustainability. The core themes of this discourse are energy efficiency and the sustainable handling of non-renewable resources that must be addressed to secure long-term existence. It can be assumed that these trends will be long-term and will lead to far-reaching social and economic changes.

Ever since the Rio conference of 1992 and the Kyoto Protocol of 2005, sustainability has had political will behind it and will be increasingly implemented into international and national legislative systems, particularly in Europe. These new standards demand new ideas and processes in manufacturing.

Manufacturers of injection molding machines are likewise affected by these developments. A prime example is the eco-design guideline 2009/125/EG which in Germany was brought into law as the ‘Energy-driven Product Law’ (EBPG). While the eco-design guideline isn‘t directly applicable to injection molding machine manufacturers – there aren’t 200,000 injection molding machines in circulation per year in the European Union – it does have an effect indirectly on machine manufacturers, because certain components (electric motors, for example) come under the standard.

Furthermore, future operators of injection molding machines will have to prove that they have a process in place that helps to continually improve their energy efficiency. Many companies operating injection molding machines are already endeavoring to produce this evidence today. An inducement for this is a partial refund of the EEG levy on electricity costs. In Germany the tax cap has been granted since 2013 only to large companies that introduce an energy management system in accordance with DIN ISO 50001 by 2015, and also for smaller and mid-sized enterprises that carry out an energy audit in line with DIN EN 16247-1.

Fig. 3: High performance injection molding machine that is highly efficient

(Source: Sumitomo (SHI) Demag)

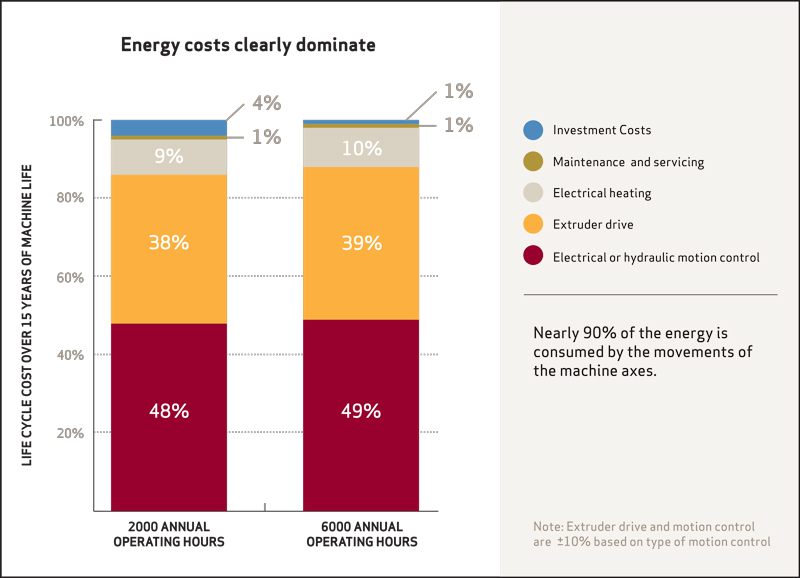

In plastics processing, the interviewees were in consensus that raw materials costs make up most of the production cost of injection molded parts. Plastics processors can influence these costs primarily through an optimized design of the mold. Apart from this, raw material costs are driven by the commodity market. However, the plastics processor can influence his direct production environment in two key ways. First, the economical use of the raw materials may help significantly reduce production costs. Secondly, processors can seek to reduce the overall lifetime costs of injection molding machines. Energy costs make up the greatest part of the overall operating expenditures (see Fig. 4) apart from raw material costs.

Energy efficient and robust quality machines are certainly more expensive to purchase than regular machines, but they do reduce the operating costs. This leads to the higher investments being relatively quick to amortize, which is why they help significantly improve the bottom line. The acquisition of more energy-efficient and sustainable machines corresponds, therefore, not only to an overall societal trend, but also to a commercial rationale.

Fig. 4: Energy costs clearly dominate the machine's life cycle cost. Source: Bonten, Resources Efficiency with Plastics Technology, 2014, S. 60

For more background on the injection molding market and details on the individual trends of energy efficiency, production efficiency, machine performance and “clean or contamination-free production”, download the full white paper.

The Moog solution: close partnership and a technology-neutral approach

The broad spectrum of injection molding applications demands different types of injection molding machines, and there are various motion control technologies for each machine type. Depending on the size, the power and the repeatability required, electromechanical, electro-hydraulic, electro-hydrostatic drives or hybrid drives (a mix of hydraulic and electric) correspondingly offer the best economy. However, most motion control suppliers specialize only in one type of technology. This kind of limited offering carries disadvantages which can often force injection molding machine manufacturers into design compromises.

Therefore, many years ago, Moog moved to a technology-neutral approach which also drew on a profound know-how of all types of motion control solutions. This is the only way that every motion control solution can be evaluated in order to fulfill the specific application requirements in the best possible way. Close partnership, high-performance key components, a firm grasp of applications and long years of experience in the plastics processing market form the basis for the development of a motion control solution best suited to carry out specific tasks.

The following brief examples illustrate this:

Example 1: For axes that must produce high forces, hydrostatic drives often offer the most economical solution. Even with injection molding machines with electromechanical main axes, an electro-hydrostatic drive could be the best choice for the secondary axes (ejectors, carriage). This solution is very robust and offers together with its high efficiency (energy efficiency), good dynamics (production efficiency and machine performance) and a sealed system (cleanliness)—advantages in all four trend areas.

Example 2: Low inertia motors are the key to the optimum performance of the clamping and injection axis. In this case, Moog’s Brushless Servo Motors with outstanding dynamics, offer attractive performance values and lead to improvements not only relating to machine performance, but also energy and production efficiency. In the liquid cooled version, the surface remains cool, thus generating little in the way of thermal air movements. This reduces dust particle migration and allows ‘clean’ production.

Summary

Injection molding machine manufacturers have the best sales prospects when they consider four key market trends: (1.) Energy efficiency (2.) Production efficiency (3.) Machine performance and (4.) Emission-free production. The requirements that link to these trends can be satisfied by different technologies. A technology-neutral approach is the most economical and represents the largest potential for motion control solutions that deliver economy, efficiency and increased performance and, in turn, generate a decisive competitive advantage for the customer.

Author Biography

Burkhard Erne, Solutions Marketing Manager in the Industrial Machinery Sector, is a graduate engineer, specializing in Mechanical. He came to Moog in 2005 in the role of Engineering Manager for electro-mechanical drive solutions. Previously, he had led development projects in motion control technology for many years, focusing on solutions to increase the energy efficiency and productivity of plastics processing machinery. Contact him at berne@moog.com.